There continues to be a remarkable

focus on green hydrogen as a clean

alternative to traditional fossil

fuels, with the past year further

accelerating its potential widespread

adoption. So, what is driving all this

hype, is hydrogen the sustainability

disruptor, and why has there been

such remarkable recent progress?

What and how?

Hydrogen is the most abundant molecule

in the universe, found primarily locked

in water and hydrocarbons. Its qualities

have been known for a long time, and

it has been used for more than 100 years

as an industrial chemical. While the

concept of hydrogen as a source of energy

isn’t novel, it has never been feasible

on a large scale – until now.

Hydrogen is a colourless gas, but it is

categorised by colour, each representing

a different production pathway. Grey

hydrogen is generated via the use of

fossil fuels, so its production emits CO2.

Blue hydrogen is grey hydrogen paired with

carbon capture and storage that covers the

majority of carbon emissions produced in

its generation. Green hydrogen, meanwhile,

is produced by the electrolysis of water,

splitting it into hydrogen and oxygen, and

as long as renewable energy is used it is

a zero-emission energy source. Thus, if

created at scale green hydrogen has the

potential to become key in decarbonising

hard-to-abate sectors of the economy.

Catalysts for uptake

For hydrogen to become a viable

solution, both greater demand and

reduced costs are required. But we are

now seeing movement on three key drivers.

Firstly, climate change is accelerating.

This feeds directly into a second key

driver – policy support for the need to do

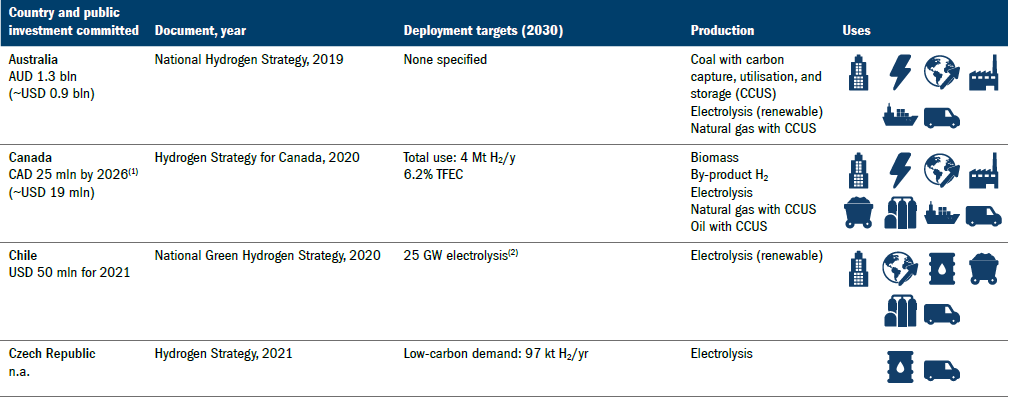

something about it (Figure 1). Since the

Paris Agreement in 2015 governments

have turned their attentions to climate change and committed themselves to

achieving emissions reduction targets

that could lead to carbon neutrality by

2050. The Covid-19 pandemic has only

accelerated the urgency surrounding

these policies. As policymakers look

for ways of cutting emissions, hydrogen

technology could be a feasible alternative.

Excitingly, the Hydrogen Council suggests

hydrogen could reduce global emissions

by 6 gigatons – or 17% of global 2020

emissions – by 2050.1 Currently, around

66 countries have net-zero emissions

targets, of which around 20 have unveiled

hydrogen roadmaps. We expect more

to follow.

The third key driver is that green hydrogen

prices have fallen dramatically in the past

10 years due to efficiency improvements.

The renewable energy used in electrolysis

accounts for about 70% of the cost of

producing hydrogen and has fallen in

price by approximately 70% in the past

decade.2 Additionally, the price of an

electrolyser has declined by about 60%

in that time.3 It is reasonable to expect

these price falls will continue, adding

to the appeal of green hydrogen.

Figure 1: Governments with national hydrogen strategies; announced targets; priorities for hydrogen and use; and committed funding

Source: IEA (October 2021).

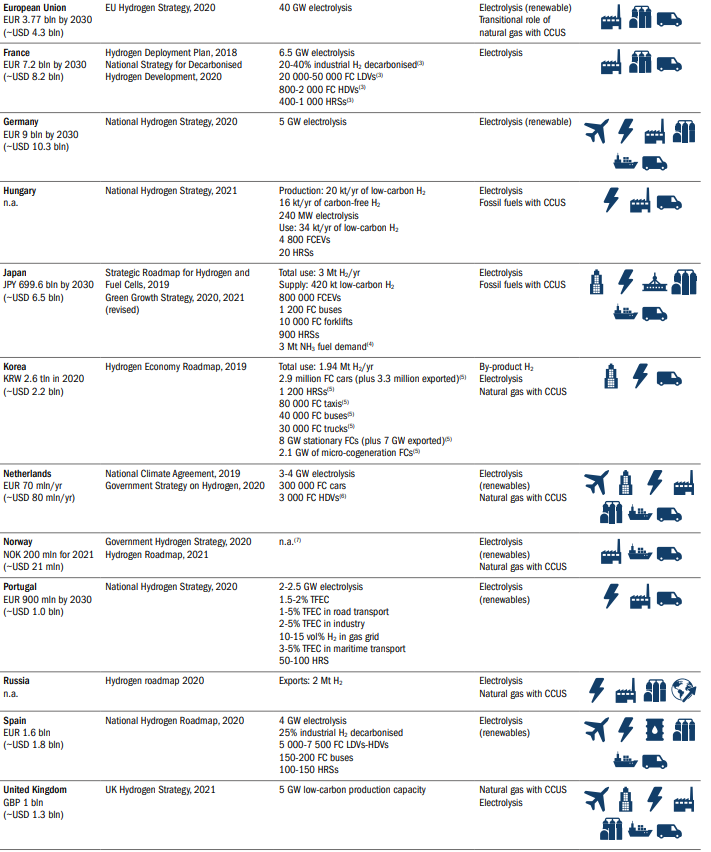

Figure 2: Company and analyst transcript mentions

Source: MS Sept 2021.

What has changed in the past 12 months?

While discussion around green hydrogen

has seen steady growth, there have been

disproportionate levels of debate over

the past six and 12 months (Figure 2),

far exceeding any other topic including

5G, Blockchain and AI.4 So why the surge

of interest?

First and foremost, there is continuing

momentum in a number of factors that

have been key catalysts for increased

uptake over the past decade. Regarding

efficiency and costs, 2021 projections

suggest reductions in the hydrogen cost

curve, while manufacturing scale should

support a rapid pick up in adoption from

2030 onwards in many different industries

ranging from chemicals to trucking fuel

cells.5 A recently revised forecast by

Bloomberg puts green hydrogen costs

13% lower than previously suggested

by 2030.6 With prices of carbon at high

rates globally, and at recent all-time highs

within the EU,7 hydrogen’s potential as a

significant decarbonisation solution has

never had as much commercial viability.

The emergence of multiple exciting

hydrogen projects over the past 12

months have been influential in these

reduced estimates of cost and efficiency

improvements. Between December 2020

and August 2021 alone, the number of

green hydrogen projects increased more

than three-fold,8 with 359 large-scale

projects announced globally. Europe is

leading the way with investments of

$130 billion, but other regions are

catching up. China is also emerging as a potential hydrogen giant with

more than 50 projects in the pipeline

following its announcement of net-zero

emissions by 2060.9

A major cost development came to

light in the Q3 2021 report of NEL, the

world’s largest electrolyser producer.

It had been widely expected that the

cost of green hydrogen would be less

than $2/kg by 2030.10 But costs are

falling rapidly and NEL now has a green

hydrogen cost target of $1.50/kg by 2025.

This illustrates the pace of innovation

within green hydrogen and continued

decline in the cost of renewables globally.

Arguably the most influential element

in the progress of green hydrogen

production as a sustainability disruptor

is government support. Simply put,

governments across the world need a

plan for life after fossil fuels, and their

ability to create policies and regulations

to support green hydrogen both financially

and in terms of infrastructure could

prove vital in its viability. It is one thing

producing green hydrogen at a cost of

$1.50/kg, but for uptake to be aligned with

net-zero targets it needs to be delivered

to the end customer at a price that is

competitive with fossil fuels. Infrastructure

is needed to facilitate this process.

In the past year, the Chinese government

has made $20 billion of public funding

available for hydrogen projects. So far,

50% of its announced projects are linked

to transport applications, a key sector in

its energy transition plan.11 Meanwhile, the

US has renewed its net-zero commitment

by re-entering the Paris Agreement

following President Biden’s inauguration.12

In August 2021, the UK government

set its sights on developing a thriving

green carbon sector to overcome the

decarbonisation challenges facing its

economy, in the form of the UK Hydrogen

Strategy. Its ambition is to build 5GW of

low carbon hydrogen production capacity

by 2030. This could produce hydrogen

equivalent to the amount of gas consumed

by more than three million households in the UK each year.13 The UK Hydrogen

Strategy is all encompassing and takes

a holistic approach to developing a

thriving hydrogen sector. It sets out

what needs to happen to enable the

production, distribution, storage and use

of hydrogen, and to secure economic

opportunities across the UK.14

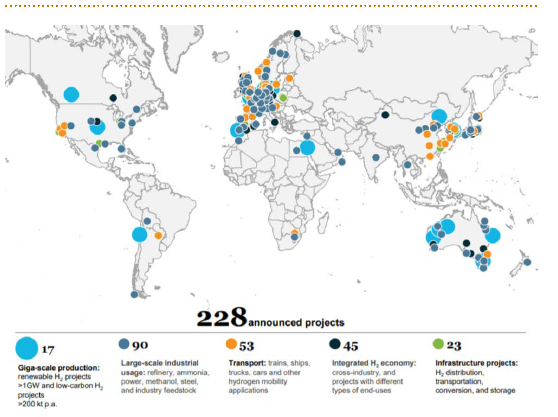

Figure 3: Private equity, infrastructure and hydrogen

Source: Morgan Stanley – The Hydrogen Handbook. The Hydrogen Council.

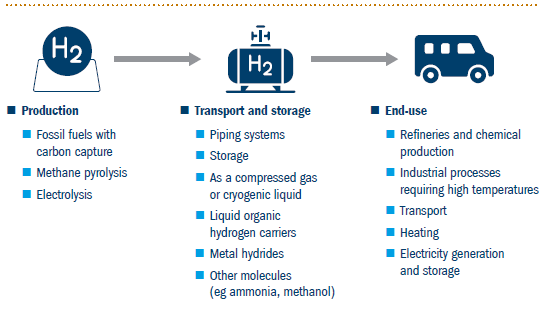

Figure 4: Identifying infrastructure investments across the hydrogen value chain

Source: Arup Hydrogen.

We are beginning to see an emergence of companies specialising in the production,

distribution and usage of Hydrogen.

Globally there are 228 ongoing hydrogen

projects across the value chain (Figure 3),

17 of which are giga-scale production

schemes. Two notable recent acquisitions are of the Canadian electrolyser company

Hydrogenics for $290 million15 by

power firm Cummins, and MAN Energy

Solutions’ majority share in Germanbased

electrolyser manufacturer H-TEC

Systems for an undisclosed fee.16

Interestingly, we are also seeing investment in riskier early-stage hydrogen

start-ups focused on the non-electrolysis

production of hydrogen. The funding

of such project development and

integration services could be indicative

of a maturing sector.17 The Hydrogen

Council estimates total investment in

the hydrogen value chain could exceed $300 billion by 2030 and, according

to the Energy Transitions Commission,

reach approximately $15 trillion by

2050.18 This demonstrates both the

requirement of, and opportunity for, private

investment within the chain (Figure 4).

While there are multiple barriers for the

uptake of hydrogen within the mainstream

– from cost to efficiency – we believe there

are two main ones. The first is current

limited demand. While from a production

perspective policy support is expanding,

technology is improving and cost is going

down, there is still a limited actual demand

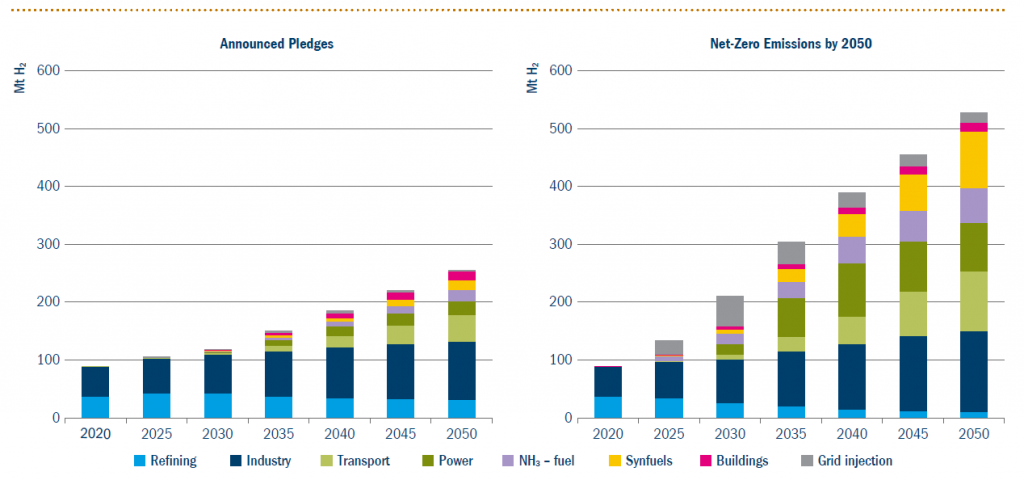

for the molecule. Net-zero pledges could

however bolster demand (Figure 5). Further

infrastructure development will be a critical

determinant as to whether green hydrogen

becomes the panacea of decarbonisation.

Second is the underappreciation of

hydrogen within society. There has been a

stigma surrounding its use as a fuel ever

since the Hindenberg disaster in 1937.

Consumers and investors must be made

aware of the promise and safety of hydrogen

before it enters the mainstream. We believe

asset managers are becoming increasingly

aware of its potential and are attempting

to educate their investors. We hope the

public can be educated in much the same

way. We believe there is a huge opportunity

for the infrastructure sector in all of this:

without infrastructure projects, there will be

no mainstream consumption of hydrogen.

Figure 5: Hydrogen demand in the IEA’s Announced Pledges and Net-Zero Emissions scenarios

Source: IEA: 2021 Hydrogen Review.

Conclusion

The opportunity for green hydrogen to

disrupt the sustainable energy industry

cannot be denied – from increasing

technological improvements to scalability

and policy support, the past 12 months

have witnessed huge advancements

– and the pace at which it could do so

must not be underestimated. On a walk

down New York’s Fifth Avenue in 1900

you would likely have seen 1,000 horses

and one automobile. Just a decade or

so later it’s likely the opposite was the

case. In 1900 the car was inefficient,

unreliable and expensive versus the horse, but the long-term opportunity

was salient. Perhaps a decade from

now we will be questioning why there

was ever a debate about hydrogen.

Lack of demand is currently the main

barrier for the mainstream consumption

of hydrogen. While policy support is

growing exponentially, it is not close to

the level needed to achieve net-zero

energy system emissions by 2050.

A mixture of such support, through

incentivisation mechanisms for the

utilisation of hydrogen and development

of infrastructure, will be vital. Signs of growing investment in the latter are

positive. However, to retain this momentum

policy will need to focus not just on

reducing costs but on creating supporting

infrastructure to ensure demand. Policy

support is strong, as illustrated in Figure 1,

but there is scope for more, especially

as countries outline their net-zero

goals. The recent rise in energy prices

may fast-track policies in the next 12

months. Post-COP26 we should have

better insights around policy support,

and we may be able to identify prominent,

fruitful infrastructure opportunities.