Holding airport bonds in our social strategies often raises questions. But aviation brings huge social and economic benefits, and is making great environmental strides

A common myth among investors seeking exposure in responsible investment (RI) strategies is that eligible investments must excel across the entire environmental, social and governance (ESG) footprint. A further fallacy is that if a company fails on the environment element, it fails the selection process.

Airports are a sector which fits these beliefs. A question we are frequently asked is how we justify including bonds issued by airports in our social bond strategies given the negative connotations associated with the aviation industry from an environmental perspective.

But there are significant social and economic benefits deriving from aviation, while airports and airlines are deeply involved with initiatives which seek to mitigate the environmental impacts of air travel. So, what may seem a contradictory position at first glance, is in fact carefully considered.

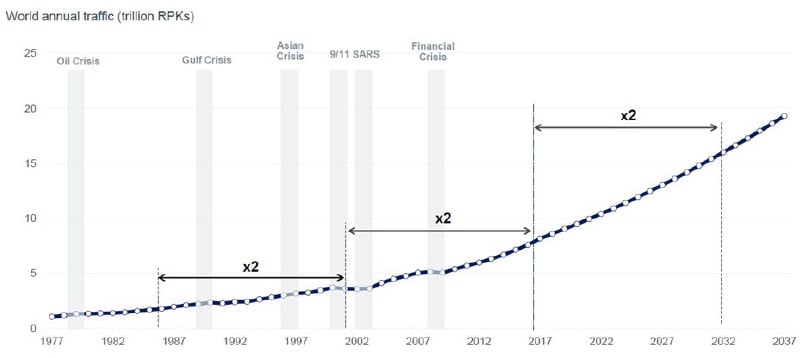

Figure 1: Traffic growth is resilient to geopolitical and financial shocks

However, many of the continent’s key airports are already operating at capacity, Europe’s airspace is in urgent need of modernisation. Action needs to be taken to avert the upcoming capacity crunch. Sustainable infrastructure investment will be required either through the bond markets or dedicated sustainable infrastructure funds to address this challenge.

Airports are social

Our response to questions surrounding the suitability of airports within an RI approach is that they are inherently social. Connecting communities and providing access to food, healthcare and education are the essential building blocks for a well-functioning society, and this is what airports deliver.

Away from major cities, the reliance on airports is even more pronounced and often, the simple need for accessibility outweighs any direct measurable economic benefit that the operation of the airport may bring; and for outlying communities, such as those in isolated parts of Scandinavia or northern Scotland, air transport services are a lifeline to enhance social inclusion.

In Australia, the Remote Air Services Subsidy helps connect 257 communities, including 86 indigenous settlements, across the country with populations ranging from six to 200 residents. Similar connectivity initiatives are happening across Asia Pacific: for example in Borneo, Malaysia’s Rural Air Service supports 49 routes on the island to aid connectivity and promote support for remote communities.2

Avinor, a holding in our European Social Bond strategy, is a Norwegian group responsible for 45 airports across the country, and is 100% state owned.3 The Norwegian government has established that Avinor should primarily operate to support the population in providing a key form of transport, rather than seeking to maximise profits. It is deemed strategically important to the country as it plays a very specific role in national, security and emergency situations. The Norwegian topography and distances between centres of population mean air travel remains the most efficient mode of transport. Fast rail, limited to Oslo, covers a relative restricted region, and there are few alternatives to flying.

Airports are not only an investment in transport and connectivity; they also have significant additional advantages. Globally, the aviation industry supports $2.7 trillion of economic activity, equivalent to the UK’s GDP or 3.5% of the world’s GDP, and generates 10 million jobs. On a regional level, airports play a critical role in local economies. Estimates vary in the range of 1.4%-2.5% of GDP, excluding tourism.4 Birmingham Airport, for example, employs 8,050 people in an area of high job deprivation, which equates to an economic impact of £250 million. Across the UK as a whole, the economic footprint of airports (both direct and indirect) is estimated to be around 16,900 jobs and £676 million in gross value added.5 As regional airports continue to expand, employment will also increase. Estimates vary, but independent analysis from aviation consultant InterVistas says airports like Birmingham will offer 1.2 direct jobs for each additional 1,000 traffic units (Figure 2).

Figure 2: How many additional jobs will 1,000 traffic units create?

1000 additional traffic units creates | |

|---|---|

Less than 1 million traffic units | 1.2 direct jobs |

1-10 million traffic units | 0.95 direct jobs |

Over 10 million traffic units | 0.85 direct jobs |

However, airports are important not simply because they create employment and economic activity in the aviation and related sectors. They also support a broad range of activities in the wider economy. Very few people fly for the sake of it; rather, flying is a means to conduct other activities – trade, business, holidays and so on. In order for Europe’s airports to continue to facilitate the wider economy, it is necessary for them to grow in line with underlying demand.

InterVistas forecasts that a failure to expand Europe’s airports could cost at least 2 million jobs and €96.7 billion in GDP. Furthermore, the majority of this loss would be in the general economy, not in the airports or aviation sector. Recent natural disasters illustrate this: Iceland’s volcanic eruption in 2010 cost the global economy $5 billion as flights were grounded across Europe for six days.6

The environmental perspective

Despite the significant economic and social benefits of airports and the aviation industry, they are typically overshadowed by environmental concerns. On first inspection the facts are compelling: aviation is one of the most energy- and carbon-intensive modes of transport, whether measured per passenger kilometre or per hour travelling.

The major concern for the aviation industry is greenhouse gas emissions and their impact on climate change. Aviation produces around 2%-2.5% of the world’s man-made CO2 emissions, according to the European Commission.7 Considering the rapid growth of aviation in recent years, and expected continuous trends, the IPCC forecasts that this will increase to around 3% in 2050.

However, both the IATA and ICAO are aiming for carbon-neutral growth from 2020 onwards and for emissions to be reduced to 50% of 2005 levels by 2050.8

So, the industry is taking note, and the push for environmental improvement is in keeping with the philosophy behind our social strategies – namely, looking for evidence to positively include issuers and not negatively exclude them.

An increasingly favored approach in fixed income markets is the issuance of dedicated green bonds, which are compliant with the International Capital Markets Association’s Green Bond Principles. With green bonds in the aviation sector, the use of proceeds is specifically targeted at reducing the environmental impact of an airport. One recent issuer is Schiphol Airport, which we hold in the European Social Bond strategy.

The proceeds from this bond are used to finance the construction of buildings and the refurbishment of existing ones. Buildings account for approximately 40% of total energy demand and 36% of total energy-related CO2 emissions worldwide.9 Improving their energy efficiency is a robust way to mitigate the effects of climate change. For example, Leadership in Energy and Environmental Design (LEED) certification is an independent verification of a building’s energy and resource efficiency, and LEED Gold-certified buildings can generate up to 34% less greenhouse gas emissions than the average commercial building.

Schiphol airport aspires to be the leader in reducing nitrogen oxides and particulates produced by motorised transport. To do so, Schiphol supports the development of electric transport to and from the airport, is installing charging stations for its own buses and passengers’ electric cars, as well as replacing passenger buses with electric models to transport people between their aircraft and the gate.

Another approach is to seek to conform to environmental standards set out by the International Organization for Standardization. For example, the Manchester Airports Group (MAG),10 which owns and operates Manchester, London Stansted and East Midlands airports, is not currently an issuer of green bonds, but all its airports are accredited to environmental standard ISO 14001, helping them to manage, understand and improve their performance in this area. In addition, Stansted has become the first UK airport to be accredited to the energy management standard ISO 50001.11

We hold MAG in our UK Social Bond strategy primarily because of these social values, but it is also responsible for a number of additional social benefits, including directly supporting the education of 30,654 young people in 2017; running “Meet the Buyers” events to match local buyers and suppliers and generating £9.3 million in sales for SMEs in 2017; and providing free English and Maths courses to enable employees, jobseekers and residents to develop their skills via Stansted Airport’s Employment and Skills Academy.

Aircraft themselves are becoming cleaner, too. The current generation of aircraft produced by Airbus burn 25%-30% less fuel than the previous generation.12 In fact, thanks to collaborative efforts through new technology and better operations, the average flight today will produce around half the CO2 that the same flight would have in 1990.13

Figure 3: Airports using sustainable aviation fuels in 2018

Source: ICAO, 2018

The industry is also increasing efforts to encourage the development and use of sustainable aviation fuel (SAF,) which is sourced from a variety of renewable or recycled feedstocks and can deliver up to an 80% reduction in carbon emissions over the complete lifecycle of the fuel.14 The first commercial flight using SAF was in 2008, and it is estimated that the millionth SAF flight will be in 2020. In fact, Oslo and Bergen airports, both of which we hold in the European Social Bond strategy, use SAF as their staple supply, while United Airlines support the use of SAF at Los Angeles Airport (Figure 3).

Airbus, meanwhile, is in testing phases with electric planes, but it is unlikely they will be used on a global scale for 12-15 years. Additionally, airports such as Heathrow offer preferential landing charges for airlines using “cleaner” aircraft. It also publishes quarterly the performance of 50 airlines on seven noise and emission metrics.

Noise has been a consistent complaint against aircraft. However, today’s latest aircraft are 75% quieter than the first aeroplanes and iterative improvements are ongoing through each new generation.15 Despite the noise reduction per aircraft, the number of aircraft movements in aggregate has increased, as has the number of complaints from communities living under flight paths.

This runs counter to the statistics which suggest the number of people exposed to significant noise levels is decreasing. In Europe, the population exposed to aircraft noise fell 2% between 2005 and 2014 as aircraft become quieter16, and air traffic controllers are working with governments to provide noise mitigation measures.

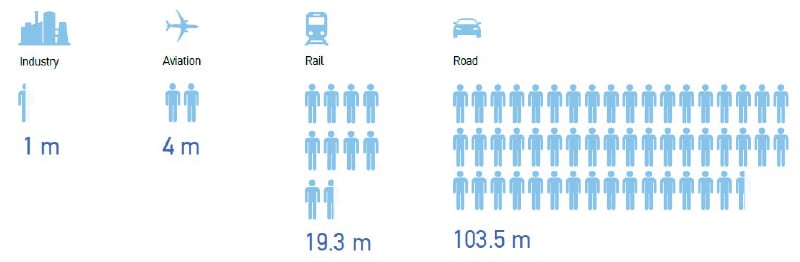

In fact, when considering transportation as a whole, aviation is not the dominant source of noise pollution. The European Environment Agency’s 2017 report shows that road traffic is responsible for the vast majority of noise in Europe, exposing more than 103 million people to levels above 55 decibels. Airport noise comes fourth with four million people affected (Figure 4).

Figure 4: Planes, trains and automobiles … and industry

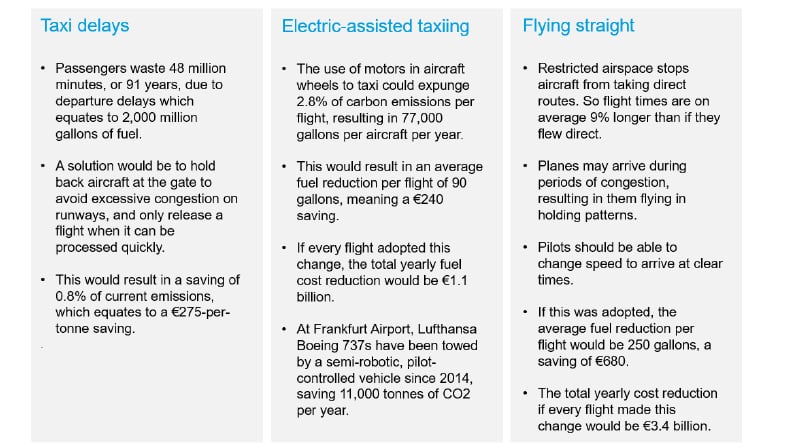

In order for the IATA and ICAO to achieve its aforementioned carbon-neutral growth goals, the aviation sector plans to introduce advanced biofuels with low emissions to offset excess emissions, and is also aiming for general efficiency improvements of between 1.5%-2% per annum. The operating efficiency of airports and aircraft is an area which, to date, has been underexploited, and there is therefore low-hanging fruit which can provide a meaningful reduction in global CO2 production:

Conclusion

Attainment of the United Nations’ Sustainable Development Goals relies on advances in sustainable air transport, which in turn is a driver of sustainable development. In accordance with the recommendation made by the UN Secretary General’s High-level Advisory Group on Sustainable Transport, all stakeholders must make a genuine commitment to transforming air transport, in terms of individual travel and freight, into something that is “safe, affordable, accessible, efficient and resilient while minimising carbon and other emissions and environmental impacts.”

Despite the environmental concerns, airports offer significant social and economic benefits. We believe airports are inherently social and thus are acceptable investments in an RI strategy. We reflect these views across our social bond strategies, which all have exposure to either UK, European or global airports. With air traffic expected to double over the next 15 years, airports will require additional infrastructure investment and bond markets, in addition to private infrastructure investment, appear to be the likely source of capital.