- The economic impact of COVID-19 will be significant in the near term but will take time to show up in the standard economic dataset.

- The response of fiscal and monetary policy is critical to stabilizing financial conditions and instilling confidence.

- There are opportunities emerging in credit markets, and investors could consider a dollar-cost-average approach in adding exposure, with a focus on investment grade credit.

It is hard to ignore how times have changed. The deliberate actions to “flatten the curve” of COVID-19 can have a critical impact to manage the spread of the virus and the burden on the healthcare system. However, the more significant the response, the greater the economic impact in the short run. While we cannot have confidence in knowing how long this will last, we can look to China where activity began to resume after about 30 days. While monetary and fiscal policy cannot cure the virus, they can play a meaningful role in bridging the gap until a time when activity resumes.

As such, we have seen aggressive action from the Federal Reserve and global central banks to move interest rates back down to 2008 levels and inject capital into money markets. Fiscal policy comes next, and developments in Washington point towards a fiscal package of over $1 trillion. While the economic impact will be material in the near term, it will take time to show up in the broad economic dataset. Nonetheless, the markets have moved meaningfully to price in this downshift.

U.S. interest rates have followed the path of global interest rates to historically low levels, but remain positive. At this point, we expect the Fed Funds rate to be anchored at 0.00 – 0.25% for an extended period given the shock and magnitude of the current situation. Recall, during the financial crisis, the Fed lowered the Fed Funds rate target to 0.00 – 0.25% in December 2008 and did not hike until December 2015. U.S. Treasury yields with longer maturities are currently trading in a range around 1.00%, which seems reasonable to us. The economic slowdown and relative level (higher) of U.S. rates globally should limit an upside move in yields for intermediate and long maturities.

High quality set to play out

High quality over low quality bonds was one of our investment themes going into the year, and we would reemphasize that theme now. Low quality bonds will be challenged by higher default rates in sectors such as high yield, bank loans, and emerging market bonds. In fact, our high yield research team continues to update and increase its default forecast, with many, many caveats. High yield valuations are back to early 2016 wides. At these levels, we would estimate that the market is pricing in a “normal recession” (i.e. not a financial crisis) including default rates around 9%. We think that is starting to provide fair compensation for expected higher defaults, but the big unknown is, will this be “normal?”

Nothing about the current environment feels normal to us. We believe a prudent, proven strategy is to slowly dollar cost our exposure to high yield higher, just getting back to neutral now, and perhaps more in the weeks and months to come.

In the current market, we believe high quality assets, including investment grade corporate bonds and structured assets are the proverbial baby getting thrown out with the bath water. While volatility has risen, we believe the risk premiums compensate well for risks in high quality assets. In addition, a recent opinion piece by former Federal Reserve Chairs Bernanke and Yellen references the potential for the central bank to include investment grade bonds in its asset purchases. That would require congressional action but could serve as an additional tool to support markets.

Be safe, but stay invested

In the short run, challenging liquidity conditions can exaggerate price moves. However, opportunities are emerging. Historically, markets turn well in advance of the improvement in economic data. We are closely watching data related to new virus cases to suggest the worst is over, combined with the policy response to help get the economy back on its feet. When investors believe the worst is over, sentiment and prices could rebound quickly.

Overall, we think this is presenting a buying opportunity, but we are being measured in our approach to adding risk, as we believe it will still take some time until we have clarity on the resolution to COVID-19. Be safe, but stay invested. Prices may move lower in the near term, but already reflect a “normal” recession which seems fair for long term investors.

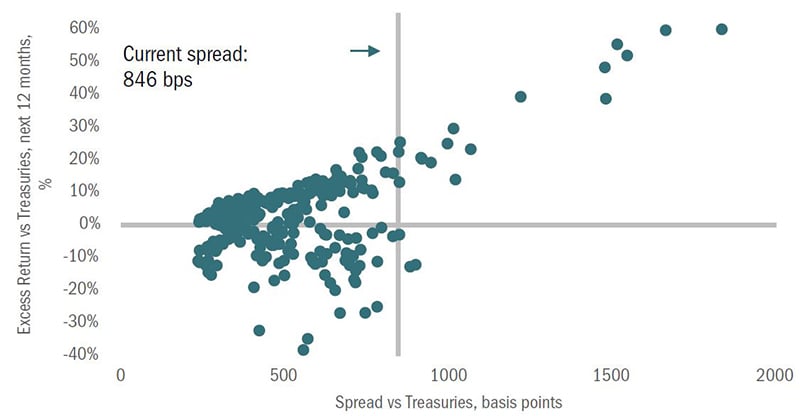

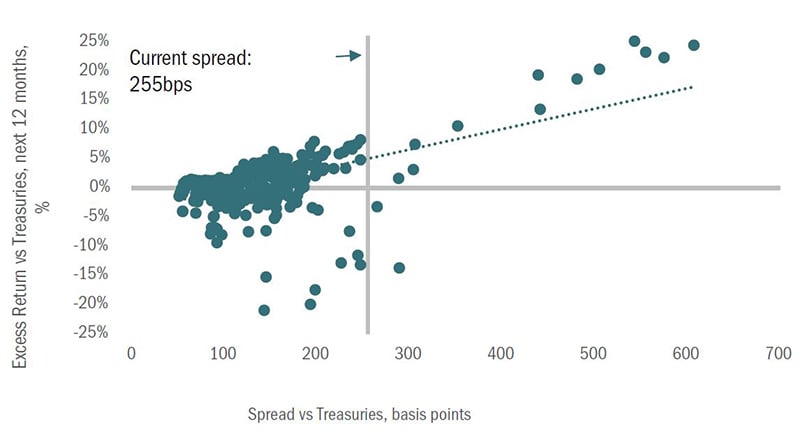

Here is some food for thought. Credit spreads have now reached levels seen few times before. Historically, when investors have invested in credit at these levels, returns over a 12 month horizon have been quite positive. It can pay to have a longer time horizon.

Exhibit 1: Bloomberg Barclays U.S. Corporate High Yield bond index: spread vs. excess return

Source: Bloomberg Barclays Indices, 3/17/2020; y-axis represents yield spreads at monthly intervals (from January 31, 1993 through March 17, 2020) and actual forward 12-month return from that point (x-axis) for the Bloomberg Barclays High yield index.

Source: Bloomberg Barclays Indices, as of 3/17/2020; y-axis represents yield spreads at monthly intervals (from March 31, 1990 through March 17, 2020) and actual forward 12-month return from that point (x-axis) for the Bloomberg Barclays U.S. Corporate index.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The Bloomberg Barclays US Corporate High Yield Bond Index measures the US Dollar-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB +/BB+ or below.

The Bloomberg Barclays US Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers.

Dollar cost averaging does not assure a profit or protect against loss. Past performance does not guarantee future results.