The impact of a coronavirus-based economic slowdown is a global GDP story, but more recently there has been an emphasis on the impact for China and emerging markets.

The MSCI Emerging Markets Index pulled back 5.1% for the week ended 31 January (versus 2.5% for the MSCI ACWI) on reduced appetite for risk, as the number of reported cases of the coronavirus more than tripled. It is now in excess of 20,000, with the first death outside of China reported in the Philippines. The current outbreak is more contagious but less deadly than SARS, and we are in the acceleration phase of infections, which is what has markets so spooked.

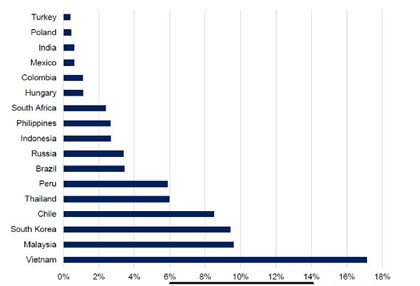

China is a much larger portion of global GDP now than it was when SARS hit (16% versus 4%), its debt to GDP is twice as large, and its GDP growth is lower (6% versus 10%). Among emerging markets economies, exposure to China varies widely (Figure 1). Stock markets in Taiwan and South Korea, which are heavily reliant on China, were down 6% and 9% respectively from 20-31 January (the S&P 500 is down 3% for the same period). The impact on Indonesia’s GDP is expected to be much more limited than Thailand’s, given it has less reliance on tourism from China. Only around 4% of Indonesia’s GDP came from tourism, with China accounting for about 13% of all inbound tourist traffic, versus 11% of Thailand GDP of which China accounts for 30%. The Association of South-east Asian Nations tourism department believes Thailand and Vietnam are the most at risk given their reliance on tourism.

During the SARS outbreak of 2003, the annual impact on Chinese GDP was estimated to be 1%. The composition of the Chinese economy is very different now, however, with consumer spending accounting for nearly 70% of GDP growth. As a result, the impact on the economy, and those reliant on Chinese consumers, may be longer-lasting.

That said, the outbreak is not expected to derail the longer-term drivers of the asset class. We expect an economic impact, but a transitory one, with a quick rebound in growth once the virus is contained. Our expectation is that the market will look through any earning misses or reduced guidance once containment is in sight. Given the quarantine in Hubei province, the epicentre of the outbreak, we are watching the rate of new infections beyond. When this reverts to linear rather than exponential growth, we will be more comfortable calling a market bottom.

Figure 1: Exports to China as a share of local GDP

Weather and central banks both matter in the coming months. As with flu season, the SARS and the 2012 Middle East respiratory syndrome coronavirus (MERS-CoV) infections ebbed as the weather warmed, and warming trends in March and early April may help limit the spread of the current virus. In the face of higher volatility and weaker global growth we expect to see central bankers in China and globally bring liquidity to the system, helping to buffer any market downturns. The central bank of China has already announced that it will inject 1.2 trillion yuan ($173 billion) into markets and pledged its commitment to use monetary policy tools to ensure liquidity remains ample and supportive of firms affected by the virus.

While we expect volatility to continue, we remain constructive about the outlook for emerging markets and China. Having said that, we had been taking profits in China even before the outbreak, given the rapid rise in some portfolio holdings over the past couple months as the risk/reward profile became less attractive and valuations fuller on a shorter-term basis following the US-China phase one trade agreement.

Fundamentally, our emerging markets portfolios have minimal exposure to areas which suffered the most in previous outbreaks, eg, tourism, catering services, transportation and retail. In areas where there may be some exposure to the coronavirus, we own the highest quality companies that have ways to mitigate the impact of the outbreak.

Going forward, given our adjustments over the past few months we are well positioned should the sell-off become more pronounced, and we are actively looking for top-tier companies/franchises that we may available at a discount. With much of China in lockdown, ecommerce and online entertainment (gaming and streaming) are potential growth areas. Once containment occurs, meanwhile, we would expect a sharp acceleration in modern retail as the government cracks down on older, unhygienic wet markets where it is believed this (and other) viruses originated.

Tutoring companies, which were already starting to transition students from in-person tutoring to digitally enabled online platforms, should also see this process accelerate. Finally, a look at the quality of health care and the need for insurance, areas of focus within our portfolio, will likely be reinforced by this outbreak

We are continuing to monitor the situation but, as with many external events that can influence markets, we will look for opportunities to add to our portfolio with great companies at compelling valuations. Given that we took profits from Chinese names that we believed had run up a lot in December, we have ample firing power when needed.