We find a hugely varied range of investment opportunities, but they have one thing in common. Many of Europe’s leading companies boast “economic moats” which keep the competition at bay. Using the Porter’s Five Forces framework for analysing a company’s competitive environment and pricing power, we find trailblazing European companies. The combination of moats and pricing power creates business models which can sustain high returns that the stock market should reward with premium ratings.

Here are ten facts Asian investors might be surprised to learn about Europe.

1. Companies with a secret ingredient

2. Spotify was founded in sweden

When most people think of successful technology companies, US leaders like Google, Microsoft and Apple spring to mind. However, Europe too boasts a very successful technological ecosystem. Many of the world’s leading talents in technology see the appeal of living and working in cities like Amsterdam, London and Berlin. So it’s no wonder that companies like Rightmove, Takeaway.com, Adyen and Spotify were founded in Europe. Once they have introduced a key technology, these sorts of companies tend to grow quickly, leaving little room for competitors and creating a sweet deal for investors.

3. Some of the biggest crises turned into the biggest recoveries

That some European countries fell victim to the global financial crisis is well documented. But these countries have also engineered spectacular recoveries. Ireland and Iceland are two remarkable success stories.

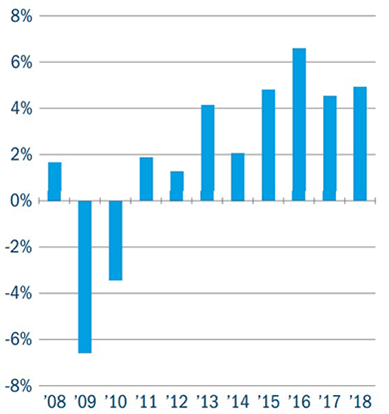

Figure 1: Iceland real GDP growth (%)

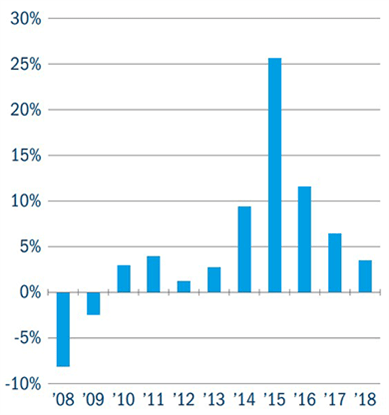

Figure 2: Ireland real GDP growth (%)

Source: World Bank GDP data (data.worldbank.org).

4. European companies are turning the continent’s ageing population into a positive

People in industrialised nations are living longer and populations in emerging and developing economies are growing – this puts tremendous pressure on healthcare. Europe has been facing the challenges of an ageing population for a long time, which has compelled European companies to become front-runners in offering appropriate solutions. For instance, European technology leaders in optics, Carl Zeiss and EssilorLuxottica, serve many critical markets including medical technology and semiconductor manufacturing equipment, as well as vision care. Those concentrated on specialized care such as Orpea provide the highest standards in services for the elderly.

5. European brands are a byword for luxury

It is very difficult to compete with the history and heritage of European luxury brands. Visit any shopping mall in the world and non-European brands are harder to find. Louis Vuitton, Hermes, Kering and Prada are global leaders in luxury leather. Commanding the highest market share in beauty globally, L’Oreal has an impressive portfolio of luxury cosmetic products. Some of the most distinguished brands in jewellery and luxury watches are owned by European companies such as Swatch and Richemont, which dominate their respective industries. After all, who can better the brand power of a Swiss watch, an Italian leather handbag or a French perfume?

6. Europe’s businesses have global appeal

7. Fancy a premier branded beverage?

8. France revived the olympics

9. Six of the ten most visited countries in the world are in europe

While Thailand’s beaches tantalise some and New York’s skyscrapers others, Europe remains the most popular destination for globe-trotting tourists. France is the most visited country in the world, with Spain in second place. Italy, the UK, Turkey and Germany also feature in the top ten. Europe may be hindered by slow short-term economic growth, but the power of history gives many of its tourist-focused businesses a major competitive advantage.

10. Lego is the biggest tyre manufacturer in the world

Forget Bridgestone in Japan, Danish company Lego is one of the biggest tyre manufacturers in the world (for use on vehicles in its Lego building sets).2