We have remarked previously on the similarities between asset management and football (Investing? It’s a funny old game, July 2018), and as Covid-19 swept the globe during the last 12 months, our thoughts once again turned to these parallels.

At times during 2020, investing in the UK felt a little like the football experience we endured

during the past year – without the crowds it was indeed a lonely game! Animal spirits, dampened

already by protracted Brexit negotiations and the resulting uncertainty, were crushed by the

pandemic last March. Investors scarpered, there was little hope factored into share prices, and

no consideration that these businesses might survive – it was act now, ask questions later. As a

result, UK equities fell by about 20%.1

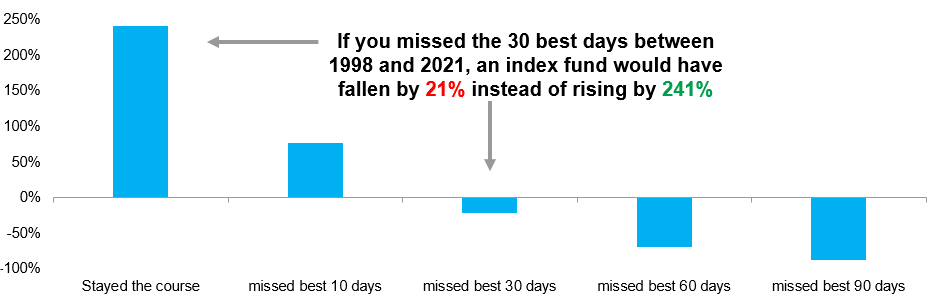

We said in another previous viewpoint that the best time to invest can be when it feels most

uncomfortable (UK equities: in need of a vaccine!, October 2020). After all, we know the dangers of market timing – in particular, when you get it wrong (Figure 1). We are pleased we held our nerve, leaned in, and bought more of these apparently beleaguered firms.

Figure 1: The fear of missing out – FTSE all share total cumulative return (1998-2021)

Source: Columbia Threadneedle Investments, Liberum, as at 22 March 2021

A game of two halves

It has been a real game of two halves to reach our current point. The market is keen to

pigeonhole investors: you are either a value roundhead or you are a growth cavalier. But we

think things are more nuanced than that: quality growth performed well last spring, while value

was hammered – but since November’s announcement on vaccines and the UK’s subsequent

successful vaccination programme, value has roared back! Many months of outperformance by

growth stocks were wiped out in a day. Covid winners became losers, and vice versa. A lot of

stocks on both sides have ended up back where they were, albeit via different routes.

Morrisons2, for example, did very well initially due to sheer volume of business as toilet roll was

anointed the new gold.3 Now, however, on the back of extra costs to remain competitive while

lockdowns kept the crowds away, it has returned to pretty much where it was pre-Covid. On the

flipside we have the likes of Wetherspoons: initially, as pubs closed, its share price plummeted;

but now, following some extra fundraising and the prospect of pubs reopening indoors, its share

price is almost exactly where it was a year ago.4 Two businesses travelling different routes but,

like salmon, returning to the same location.

Extra time ...

And now, more than a year on from Covid, we are entering extra time, but what will the final

result be?! The proliferation of quantitative investors, ETF basket trades and factor-based

investing is throwing up some interesting themes and companies that do not fit the narrow

growth/value definition. They are left in the middle. Take Morrisons again – it is not really taking

part in the opening-up trade, nor did it have an overwhelming 2020 from the crisis. But it grabbed

a lot of extra sales early in the pandemic and is a stronger business than it was pre-pandemic –

it is just not reflected in the share price. Pearson and Tate & Lyle similarly – the valuations do

not reflect their potential.

In our view, the UK remains cheap, a reflection of divestment out of the UK asset class and,

latterly, the uncertainty around Brexit and Covid. But that uncertainty has now been removed,

and the market offers global exposure alongside attractive FX and governance factors – a

valuation arbitrage remains with global firms listed in the UK trading at material price-to-earnings

discounts relative to foreign competitors. As such, mergers and acquisitions are at record levels,

at least among non-standard UK stock market participants: recent examples include Aggreko,

RSA, G4S, William Hill and Signature Aviation.5 We expect more bids to follow.

With President Biden and the US pursuing a $1 trillion-plus spending plan, and central banks

happy to let economies run hot, the spectre of inflation is rearing its head. There has been a

rush to commodities and banks, a suggestion that we are returning to the roaring 20s when

global growth was boosted by post-war sentiment. But what is not known is if this is temporary,

skewed by unusual pandemic demand trends or supply disruption causing short-term price

spikes.

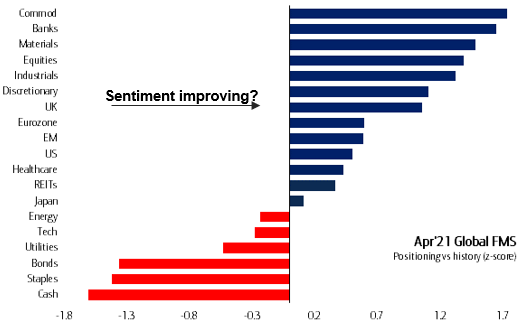

Figure 2: Global asset allocators had been reluctant to redress UK equities underweight

Source: Bank of America Merrill Lynch Global Fund Manager Survey, as at 13 April 2021. Data since 2006 for

commodities and real estate, since 2001 for everything else.

Much like at football grounds, we are now seeing the crowds return to the UK marketplace. To

extend the football metaphor, the UK has been languishing in the relegation red zone of Figure 2

for the past few years, but it is now less hated by overseas asset allocators and is climbing the

table and challenging for a place in Europe. This is the irony: it is these new faces in the crowd –

overseas investors who have perhaps not been emotionally scarred by being in the UK over the

past few years – who are set to reap the rewards, rather than UK-based investors – or traditional

season ticket holders, if you will – who are fearful of another “recovery” fizzling out and are

instead shopping for global growth products. Perhaps they have missed the memo about the

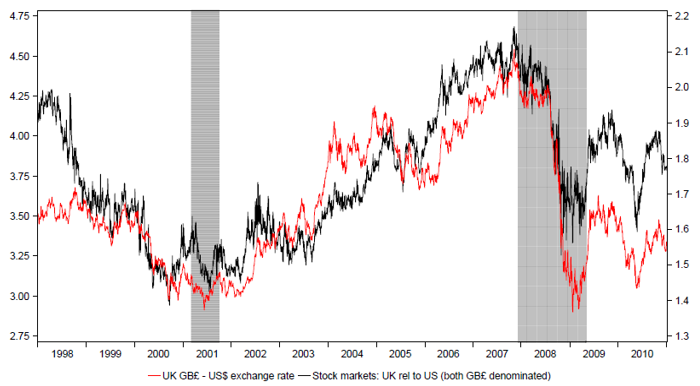

reversal of globalisation? After all, as with the period 2000-2007, the UK is quite capable of

outperforming the US (Figure 3).

Figure 3: UK stock markets relative to US (shown with GB£-US$ spot rate)

Source: Longview Economics as at 17 March 2021. Indices quoted are FTSE All-Share and S&P500

But rather than simply a value rotation, reflation and this rush to financials, banks and miners

(we do not believe we are at the start of a supercycle), we favour a slower burn reappraisal,

pound for pound across the UK marketplace. It is not just about deep value and it is not just

about high quality growth, there is more to UK equities than this – we still want optionality to

cover multiple scenarios. A midfield general, so to speak, good at defence but able to score

goals.

... and penalties?

From here it is certainly going to be interesting, and there are a number of discussion points.

People feel emboldened, but what happens when the fiscal stimulus is removed, when furloughs

end? Sadly there will be insolvencies, more so than after the global financial crisis, as banks

have more capital and can afford to call in bad debts. A sustained period of real rising inflation,

not just noise and upticks, would restrict the US Federal Reserve’s behaviour. Will Chairman

Jerome Powell really be allowed to run the economy hot, and for how long can global central

banks keep controlling markets? In three months the Fed has increased the US deficit more than

in the combined five previous recessions of 1974, 1982, the early 1990s, 2000 and 2008. 6 How

this all plays out will be key.

The (portfolio) manager: Richard Colwell struts his stuff by the Charlton Athletic dugout

Looking forward

The UK remains a rich hunting ground. It has rallied a long way in some of the most distressed

areas, but we feel there is still much further to go. For us it is not just because value has perked

up or because inflation might be coming down the track – as active managers we consider it a

broader reappraisal of UK companies quoted on the UK stock market. We are experienced, we

have been through down cycles before, and we know that keeping that optionality and keeping

an open mind on any struggling sectors of the market serves us well.

It would have been brave to have put all your chips on the post-lockdown opening up trades,

even though in hindsight that was the thing to do – but happily we captured a sizeable share of

that. Just as it would have been wrong to go all in on resilience, perhaps it is now too simplistic

to continue buying more and more banks and commodities and playing the reflation trade.

The UK market is going to be more nuanced than that, it is a stock picker’s market, and we have

the team and structure to do this. We have a fundamental research process that can uncover the

hidden gems, an eye on unloved stocks that have disappointed but remain good businesses with

restraining issues, and the active engagement with company management to probe the reasons

behind their performance.

We also have a say in stewardship and governance – perhaps, to return to football a final time,

something the big six might have considered before the ill-fated European Super League break-away!7 In summary, everything that makes up the benefits of active management. We will be

pragmatic and patient as the recovering UK looks to deliver on the opportunities it has promised

for the best part of a decade.