It might be a cliché, but history does repeat itself. Investors are always too fearful approaching the bottom of a cyclical downturn and miss opportunities that in hindsight are obvious. But fundamental and empirical evidence discussed here suggests we are within range of one of the best opportunities in UK small and mid-cap in a decade

While the resources-heavy FTSE All-Share is barely down year-to-date, the UK small and mid-cap benchmarks have retreated between 15%-25%1. The market has been battling several headwinds, including a maturing recovery post-Covid, the removal of quantitative easing and steepening of the yield curve, and fears around the effects of supply-driven inflation on demand and, ultimately, corporate profitability.

What remains clear to us as small and mid-cap investors, however, is that there are always opportunities at the smaller end of the market, regardless of the wider environment. In a short, shallow recession in particular, small and agile businesses that have seeded new markets or are disrupting incumbents can still generate attractive performance. Calling the bottom is of course difficult but, as we will show, UK small and mid-caps historically have outperformed significantly following a cyclical trough, with much of this delivered in the early stages of the recovery. So in our minds the most crucial question to ask yourself is, should I be invested in the space for the rebound?

A look at history

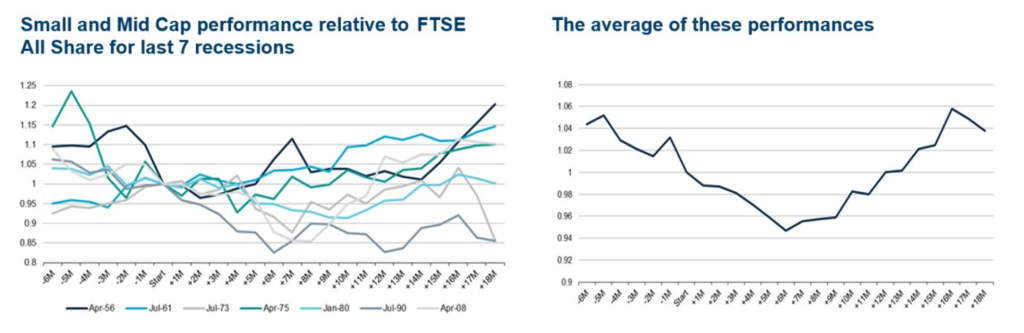

The following charts communicate a powerful message. What is important is that they are based on empirical evidence and not on biased speculation regarding potential outcomes of the current situation. Figure 1 shows the average relative performance of UK small and mid-caps throughout the last seven recessionary periods (along with individual performances in the left-hand chart). It highlights that, on average, small and mid-caps underperform large caps for four to five quarters, before going on to outperform for (at least) five to six.

Figure 1: previous recessionary performance

Source: Numis, May 2020. Past performance is not a guide to future returns

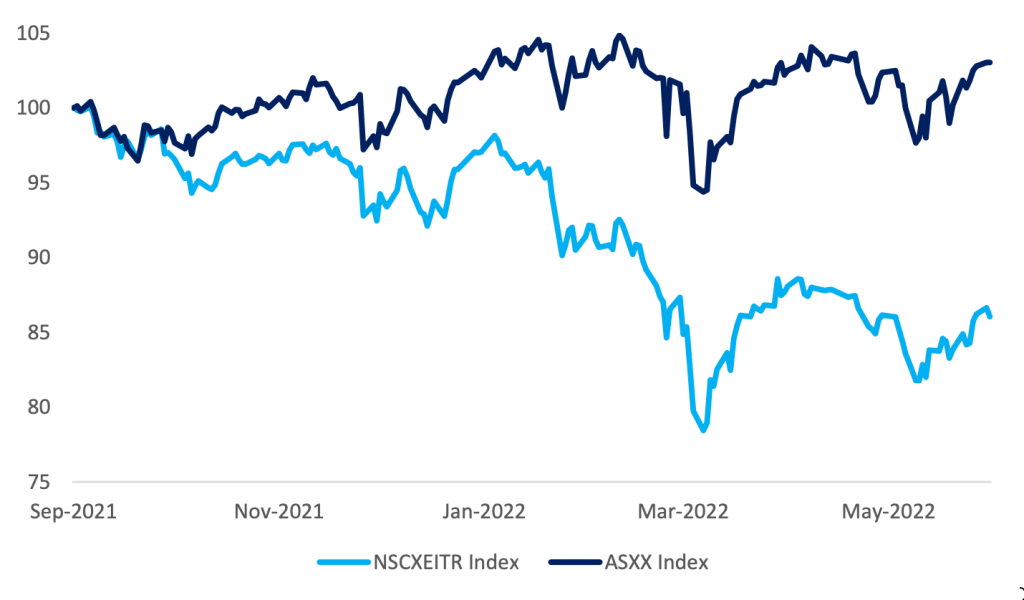

Looking at where we are now (Figure 2) we can see that the underperformance of UK small and mid-cap markets began in Q3 2021, meaning we are now entering the fourth quarter of the period of underperformance. Empirically then, as described above, this period of underperformance could come to an end later in the summer.

Figure 2: UK small and mid-cap index (NSCI) versus FTSE All-share index (ASXX), September 2021-May 2022

Source: Bloomberg, May 2022; NSCXEITR – NSCI ex-IT; FTSE All-Share ex-IT. Past performance is not a guide to future returns

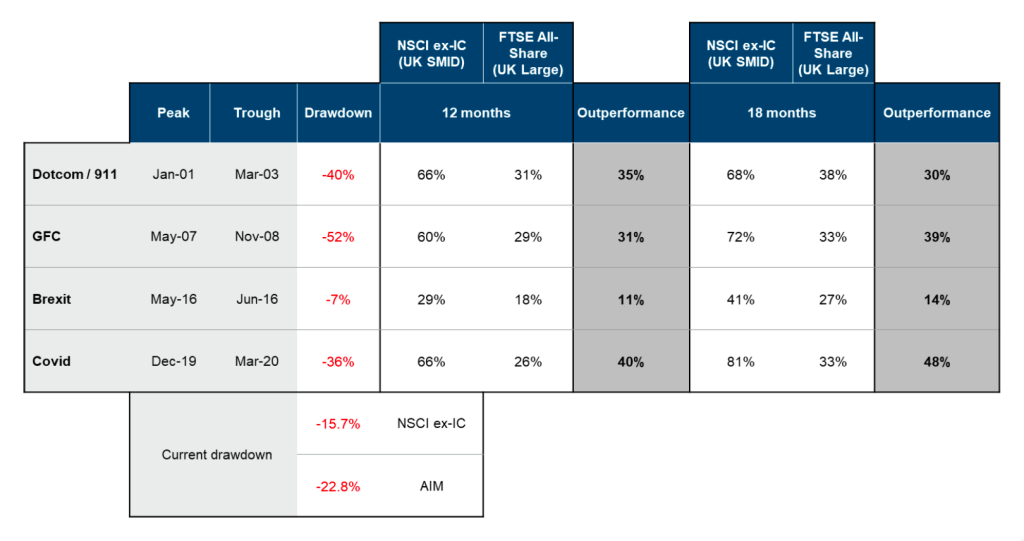

Attempting to accurately call the bottom of a sell-off is very difficult, but the historical extent and duration – potentially upwards of 18 months – of the subsequent small and mid-cap outperformance versus UK large caps is clear (Figure 3). Therefore, we believe it’s a good time to be invested in the asset class for the rebound.

Figure 3: UK small and mid-cap outperformance over 12 and 18 months from trough

Source: Bloomberg, May 2022; NSCXEITR – NSCI ex-IT; FTSE All-Share ex-IT. Past performance is not a guide to future returns

Fact not speculation

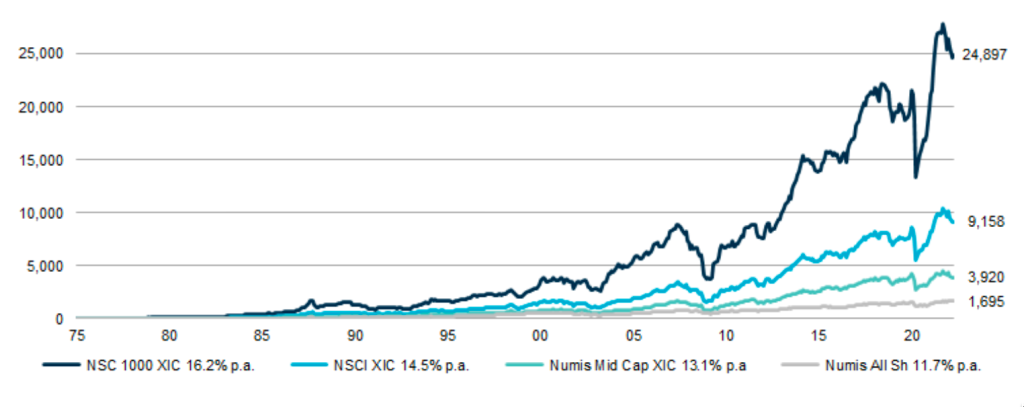

The nature of smaller companies being able to quickly innovate, take market share and align with new growth markets is well understood. This drives a low correlation to GDP with underperformance during risk-off or recessionary periods driven more by liquidity and not by deteriorating operational performance. It also drives the faster and more pronounced historical rebound versus other markets. Ultimately, the short-term volatility in the asset class has proven many times throughout history to be a significant opportunity (Figure 4).

Figure 4: cumulative outperformance of UK small and mid-cap indices vs large-caps, 1975-2022

Source: Numis, 31 March 2022. Past performance is not a guide to future returns

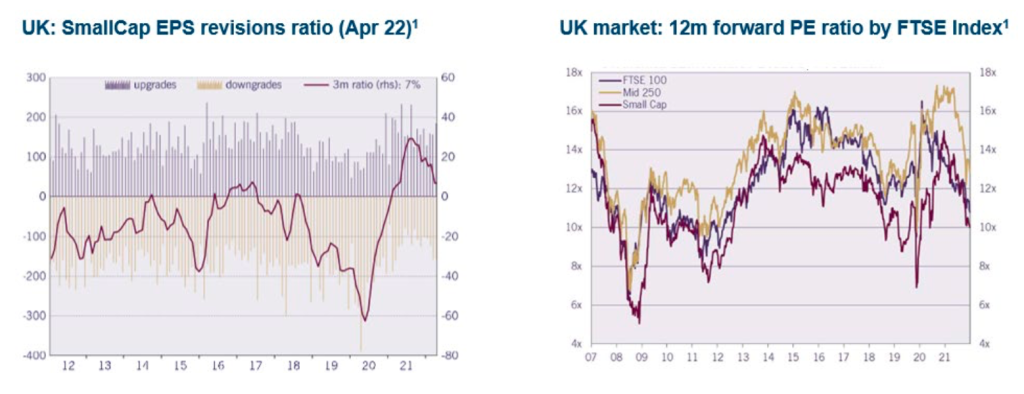

Furthermore, fundamentals are supportive in that valuations are implying – and already pricing in – very significant earnings downgrades of up to 40% over the next 12-18 months (Figure 5). We believe this is unlikely and that downgrades will in fact be limited to certain sectors and businesses whose profits are highly economically sensitive. We have spoken to a number ofcompanies who are confident that they are seeing signs that inflation is peaking and supply-chain pressures easing, while both consumer and corporate balance sheets remain healthy. Historically, deep and prolonged recessions have rarely, if ever, occurred without financial or banking system distress – something that is not evident at this point.

Figure 5: earnings revisions may be falling, but forward PE ratios are implying earnings downgrades of 30%-40%

Source: Peel Hunt, 4 May 2022

Discounts and takeovers

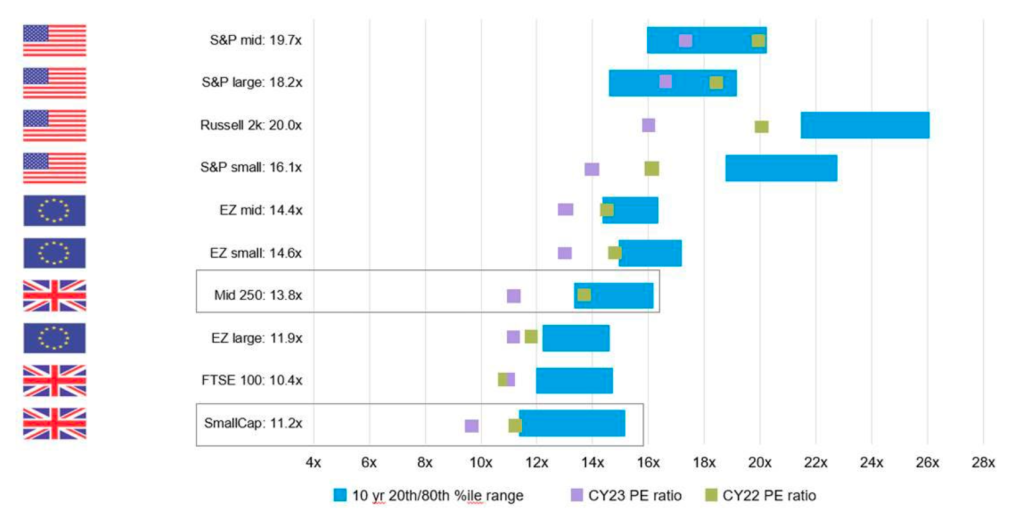

Another factor to consider is that, from a global asset allocators perspective, the UK market as a whole is especially ripe for outperformance given the discount valuation versus both history and global comparatives (Figure 6), with the historic growth rates of smaller companies particularly appealing.

Figure 6: World markets – IBES consensus PE ratios

Source: Peel Hunt, as at June 2022, by CY23 PE

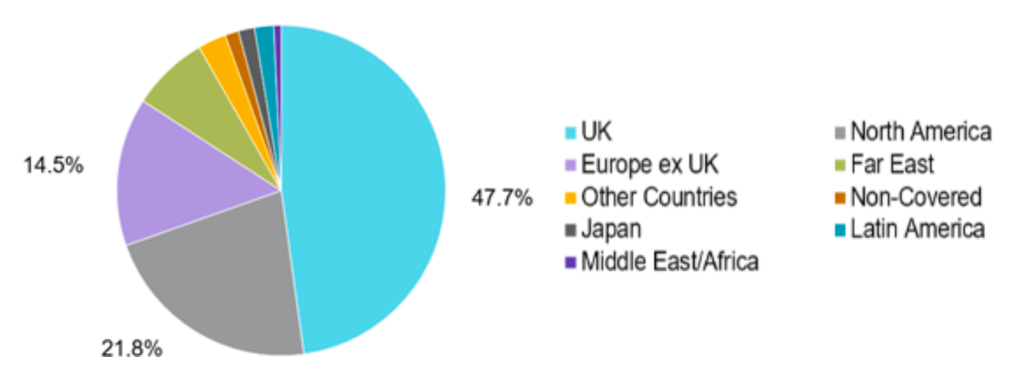

Investors looking elsewhere are missing out on the opportunity to invest in global businesses that choose to list in the UK due to the rich heritage of the stock market, but that are trading on multiples substantially below their global peers. It is often forgotten that the UK small and mid-cap market has a large exposure to businesses with global revenues and is not just a proxy for the UK domestic economy. As an example of this, Figure 7 shows the breadth of the global exposure achieved by the Threadneedle UK Mid 250 strategy. These are generally global market leaders in substantial and growing market niches.

Figure 7: Threadneedle UK Mid 250 strategy revenue exposure by region

Source: Columbia Threadneedle, 31st March 2022. For illustrative purposes only

This valuation discrepancy means the UK small and mid-cap market is primed for M&A – something that is happening even during the recent significant volatility as global private equity seeks to take advantage. Brewin Dolphin, Clipper Logistics, Johnson Matthey, Homeserve, John Menzies, Ted Baker, ContourGlobal and Biffa have all been subject to bids in recent weeks. As the clouds clear there will be even more reason to expect further M&A activity to drive performance.

What next?

Finally, let’s consider the possibility that inflation is here to stay, albeit at substantially lower levels than is currently being felt by the global economy. In this new world, what asset classes would we expect to outperform? Bonds may struggle; private equity will be shown to have benefitted from significant leverage, the cost of which will now be materially higher; growing concern over the US-China power struggle will increase the long-term risks for emerging markets; and in a geopolitical environment where global property rights are not being respected – as in China, Russia, and even the US under Trump – the UK’s legal system appears the most robust.

We would say, therefore, that UK small and mid-cap is one of the more attractive spaces for global investors – a vibrant area of the equity market with significant depth. In a world of elevated inflation, quality growth equities led by real earnings progression, rather than expanding multiples, will drive the market, making the UK small and mid-cap space an attractive area to invest for the rebound and beyond.