As we approach the end of our eighth week of working from home here in the UK, what has the experience been like? Perhaps we should start by outlining the strengths of the working system at Columbia Threadneedle Investments in normal times.

We believe in our investment philosophy of investing in quality growth companies and, when we find them, tending to stay with them for long periods of time to allow them to compound returns above the market. To find them we staff our investment process with intelligent, balanced and naturally inquisitive people who believe that together we can reach better decisions than we can as individuals. Collaboration is a key competitive advantage of our business, which is one of the reasons we have a large open plan office with numerous breakout areas. We talk of our “perspective advantage” as a firm and this comes from our formal, floor-wide macro, themes and weekly meetings, our Global team meetings, as well as our informal discussions. In the Global team we feel as though we are at the heart of a global organisation, listening to and helping to pollinate ideas that can become part of our clients’ portfolios.

So how does that translate to working from home? Well, week one involved getting the technology set up. Did you remember that Bloomberg unit? How do I hook up an extra monitor? Can I link my spreadsheets? Thanks must go to our IT helpdesk for their endless patience, although sadly they can’t fix broadband speed without a telecom provider’s assistance. Finding the best slot in the house and the right chair was also an issue. The result being that we all have access to the usual files and spreadsheets; to systems such as our front office systems; and critically our dealing desk is fully operational for when we wish to trade. The same processes that hold in the office, like our four eyes check for trade approval, function when we work from home.

As time has progressed, the use of Skype accelerated, as well as a host of other forums we had never used before – Zoom, Webex and so on. Video calls reinforce the need to shower and change out of our pyjamas and fluffy slippers before the morning meeting … or perhaps that’s just me. While the demand for paint has collapsed in the crisis, I predict a sharp rebound – that wallpaper really has to go if the whole world is being invited into my lounge/kitchen/spare bedroom.

Since lockdown began, we have held a global themes meeting on the subject of identifying winners in the recovery, which featured 230 participants in two continents, and our regular Tuesday morning update meeting with contributions from across asset classes. There was also a special meeting of the Global Financials Perspectives Roundtable to understand the changing financial risks in this crisis.

The Global Equity team has continued its regular morning meeting and held stock reviews in conjunction with Central Research on subjects as varied as the payments space, animal health and software names. We have had update calls with companies we hold and input from analysts and consultants. The formal part of the investment process works well from home. The harder part to replicate is the informal conversation, the impromptu discussion as a result of an overheard discussion. But this is starting to build through email and chatroom threads as we get more used to the new environment. Even the older luddites like me are adapting. The dealing desk jokes and the social chit chat that keeps us all sane has also reappeared.

So, why don’t we just work from home all the time? The investment process works. We avoid the interruptions endemic in an open plan office; our job involves thinking and actually having the time to think is critical. However, we believe that sharing this thinking and debating insights ultimately gets us to a better decision. This is best done face to face. I am sure our work and travel patterns will change as a result of this enforced experience, but our investment process will endure.

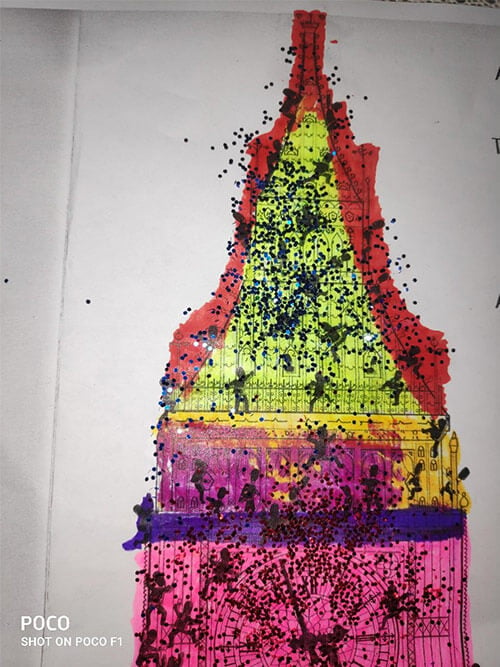

Of course, the real reason for writing this note is to exhibit some of the artwork of our team members’ children. Schools in the UK have now been closed for around eight weeks also, and finding time-consuming activities that enable parents to do some work is a challenge. How is the home schooling going? Here is a selection…

By Julia, age 7

By Suhavi, age 4

By Juliette, age 9.