As one of the world’s largest economies the US is a key focus for investors. With every country

attempting to return to normality following the coronavirus pandemic, we are monitoring when US

economic activity might get back on track, as well as other measures of “normality” such as

entertainment and leisure, high street shopping, and schools reopening. The result is an index that

measures progress toward a post-pandemic world

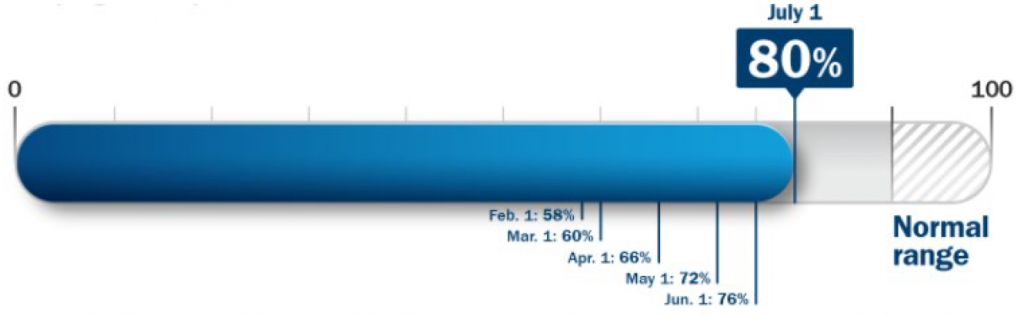

Our Return to Normal index

As the US continues its Covid-19 vaccination program, the Return to Normal Index measures

human activity data relative to pre-pandemic levels. The index is constructed by our data

scientists and fundamental analysts and tracks activities in the US, including travel, returning to

work and school, brick-and-mortar shopping and eating out. By design, the index is focused on

measuring components of daily life rather than economic indicators such as GDP growth. The

percentage level will move closer to 100 as daily life normalises, and our analysts will update it on

a regular basis.

What has changed?

Since our June update, the Return to Normal Index has climbed up to 80% from 76%, with gains

across all index components. After accelerating quickly around Memorial Day (31 May), the index

moderated its upward trajectory in June. We may see a similar uptick in activity around the 4 July

holiday, and we believe the US could reach the normal range by August or sooner. We are

monitoring the spread of the Delta variant, which has demonstrated that it is more transmissible

than other coronavirus variants. Vaccinations, especially the Pfizer/BioNTech and Moderna mRNA

vaccines, have proven to be highly effective and, in most cases, have been successful at

preventing serious illness from even the Delta variant. We may see increased Covid cases in the

US in the short term, but there will most likely be a limited impact on human activity. Health

authorities will be watching closely and determine if some restrictions need to return temporarily.

Activity numbers won’t all return to where they were before Covid. The index could hit “normal” at

a point lower than the 100 level due to continued changes in behaviour, like working from home

and reduced business travel. The definition of the future normal is evolving, and the index’s

normal threshold will reflect our data science and fundamental research insights.

Figure 1: The Return to Normal Index tracks activity compared with pre-pandemic levels as we

progress to post-Covid life

Source: Columbia Threadneedle Investments, 1 July 2021

What are we monitoring, and where is it at?

We are analysing the time people spend engaging in a broad set of activities outside their homes

(Figure 2). The index components have implications for economic growth, but the primary

objective is to monitor how close or far we are to returning to normal life.

Figure 2: Tracking inputs

Our index suggests we’re still 20% below pre-Covid activity levels. The levels of component

activity vary: the return to brick-and-mortar stores is 13% below its pre-Covid levels and a normal

work routine is 19% below pre-Covid. Travel and entertainment activity has recently had a

stronger recovery, but it continues to lag other categories at 23% below pre-Covid levels. The

return to school data may not see a meaningful gain until the fall – as long as a return to in-person

schooling is more widely implemented

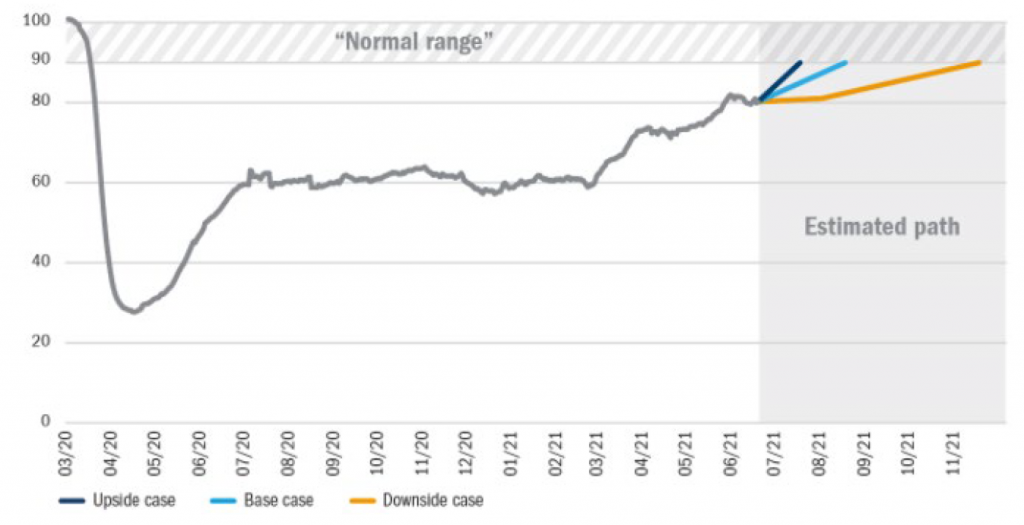

What could drive change?

Faster vaccine distribution and uptake could accelerate the path to normal (ie, the upside case).

Developments that could impede a return to normal (ie, the downside case) include the

emergence of variants that are resistant to current vaccines or slower uptake of the vaccine in

certain places (because of people’s unwillingness to get vaccinated or shortfalls in supply).

Figure 3: The Return to Normal Index over time – level as of 1 July 2021: 80%

Source: Columbia Threadneedle Investments, 1 July 2021

This index provides a framework as we analyse companies. It is a roadmap for what normal

activity might look like after Covid and how long it will take to get there. The information allows us

to test a company’s own assumptions and make adjustments in our views as needed.

For investors, the Columbia Threadneedle Return to Normal Index can act the same way: it’s an

additional input to consider as they research their individual asset allocation and portfolio

decisions.

Understanding where we are on the path to normal life will be a critical question in 2021. This

data can help inform investors’ asset allocation decisions and set expectations on market activity.